ESG Topics A-Z

Green Bond

To PepsiCo:

PepsiCo's Green Bonds – among the first in the food and beverage industry – are one of the many tools we're using as part of our sustainability journey.

To the World:

Green Bonds are a means of raising funds for sustainability projects from external investors. They help enable companies to accelerate sustainability initiatives while helping investors to align sustainability and financial priorities.

Approach

Enabling progress across PepsiCo's sustainability initiatives takes innovation, partnership and investment. Pioneering funding mechanisms such as Green Bonds help us to channel investment into a selection of those sustainability initiatives.

In October 2019, PepsiCo issued its first Green Bond, a 30-year, $1 billion senior notes offering. The net proceeds from this offering were allocated to investments in projects relating to sustainable plastics and packaging, work to reduce carbon in our operations and supply chain and initiatives supporting water sustainability to advance certain United Nations Sustainable Development Goals (SDGs). As of December 31, 2021, net proceeds from the first Green Bond were fully allocated.

In July 2022, PepsiCo issued its second Green Bond ("2022 Green Bond"), a 10-year, $1.25 billion senior notes offering, based on an updated Green Bond Framework. This new framework outlines the categories where net proceeds can be allocated towards Eligible Green Projects,1 each one aligning with certain UN SDGs, which provide an important inspiration for the company’s priorities:

- Circular economy and virgin plastic waste reduction (UN SDG 9 – Industry, innovation and infrastructure; and SDG 12 – Responsible consumption and production)

- Decarbonization and climate resilience within our operations and value chain (UN SDG 7 – Affordable and clean energy; and SDG 11 – Sustainable cities and communities)

- Pursuing net positive water impact (UN SDG 6 – Clean water and sanitation; SDG 12 – Responsible consumption and production; and SDG 15 – Life on land)

- Regenerative agriculture (UN SDG 2 – Zero hunger; and SDG 8 – Decent work and economic growth)

To allocate funding from the net proceeds of the second Green Bond, PepsiCo’s sustainability team assesses and determines project eligibility and recommends an allocation of proceeds among Eligible Green Projects to the PepsiCo finance department, also providing them with project descriptions. The PepsiCo finance department tracks allocation of proceeds to such projects. Material project risks are also evaluated to ensure they fit PepsiCo’s risk management practices.

Throughout the term of the 2022 Green Bond and until the proceeds have been fully allocated to Eligible Green Projects, PepsiCo publishes an annual update (“Green Bond Report”) of the allocation of the proceeds, including, subject to any confidentiality considerations, additional descriptions of select projects funded with 2022 Green Bond proceeds. Green Bond Reports are accompanied by: (i) an assertion by PepsiCo management specifying the amount equivalent to the net proceeds of the 2022 Green Bond that PepsiCo has allocated to Eligible Green Projects and (ii) an assurance report from a nationally-recognized firm registered with the Public Company Accounting Oversight Board in respect of its examination of PepsiCo management’s assertion conducted in accordance with attestation standards established by the American Institute of Certified Public Accountants.

Progress

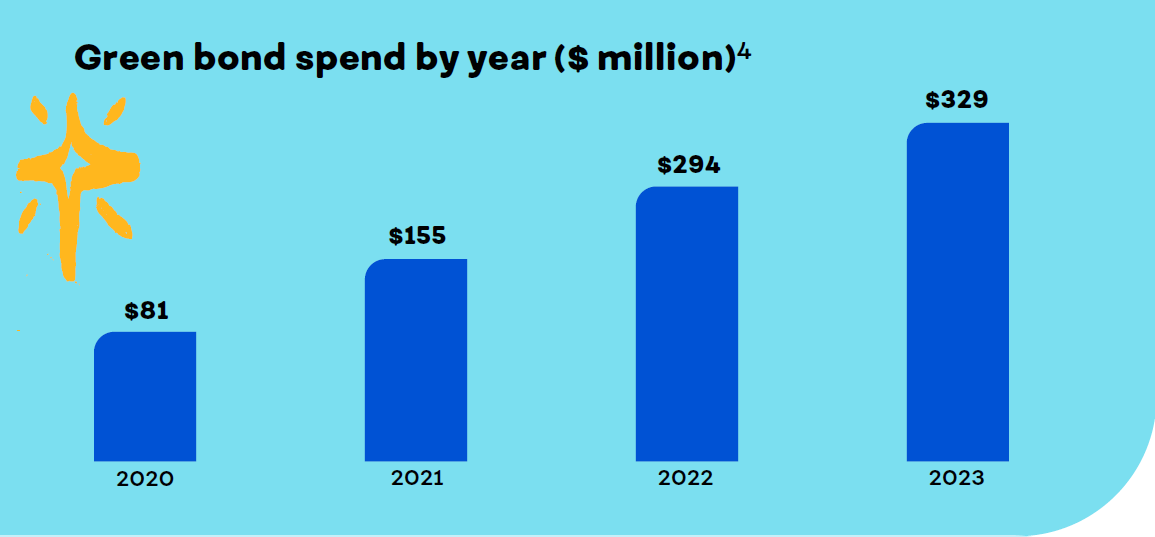

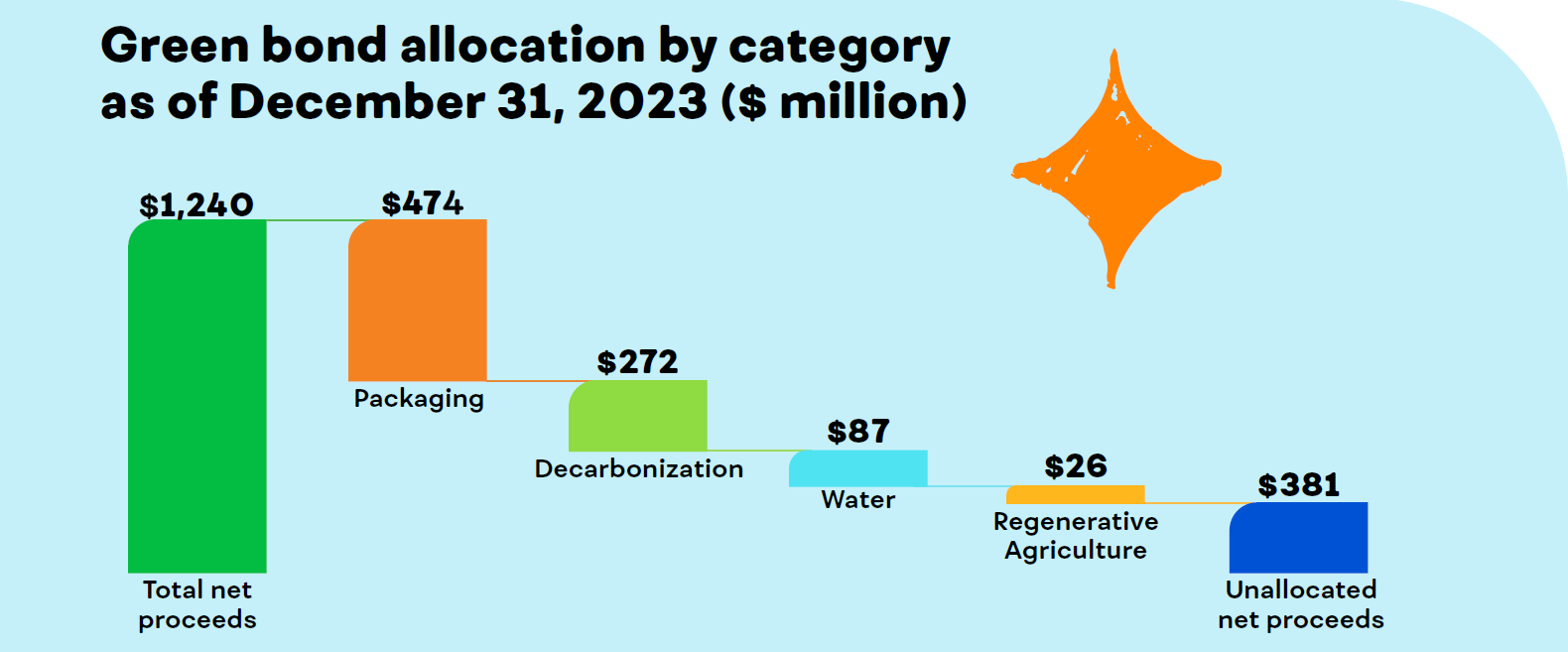

As of December 31, 2023, PepsiCo had allocated $859 million in proceeds from the issuance of our second Green Bond to Eligible Green Projects. This represents approximately 70% of the net proceeds and includes over 250 individual investments.2

Since issuing our second Green Bond, we have used the proceeds to allocate:

- $474 million towards projects to improve packaging circularity, avoiding approximately 230,000 metric tons of greenhouse gas (GHG) emissions compared with using virgin plastic;3

- $272 million to decarbonization projects completed between 2020 and 2023 that are expected to help reduce our Scope 1 and 2 GHG emissions by over 125,000 metric tons per year;

- $87 million to pursue a net positive water impact, replenishing more than 7 billion liters in high water-risk watersheds since 2020, and completing projects between 2020 and 2023 that are expected to avoid the use of 2 billion liters of water in our operations annually; and

- $26 million to support regenerative agricultural practices, covering more than 2 million acres.

What's next?

We will continue reporting annually on the allocation of spend from our 2022 Green Bond until the proceeds have been fully allocated to Eligible Green Projects.

1PepsiCo’s second Green Bond prospectus, aligned with our Green Bond Framework, defines “Eligible Green Projects” as new and existing investments made by PepsiCo during the period from January 1, 2020 through the maturity date of the notes, in four categories: circular economy and virgin plastic waste reduction, decarbonization and climate resilience within our operations and value chain, pursuing net positive water impact, and regenerative agriculture. Each of these categories aligns with certain relevant UN SDGs, which provide an important inspiration for the company’s priorities

2Investments include expenditures on capital projects and other sustainability-related operating expenses excluding non-cash items like depreciation and amortization

3Avoided emissions represent the calculated difference in emissions between virgin and recycled PET plastic, using third-party emissions factors provided by Franklin Associates for each year and region where rPET is purchased and PepsiCo’s purchased packaging volume of rPET

4"Eligible Projects" include new and existing investments made by PepsiCo during the period from January 1, 2020 through the maturity date of the notes. Accordingly, as of December 31, 2023, net proceeds had been allocated to projects undertaken between 2020 and 2023. This graph shows the years the funds were spent. Note that subsequent to the publication of the 2024 Green Bond Report, further proceeds may be allocated to projects occurring between 2020 and 2024, so totals in this graph may change in future reporting

Related topics

Agriculture, Climate change, Fleet decarbonization, Packaging, Renewable energy, Water

Downloads

Last updated

October 29, 2024